Over 50% Bank Locker Holders Relook at Facilities Over Cumbersome Paperwork, High Charges: Survey

The survey also found that 36% of the respondents are fine with the new charges, and will continue with the locker facilities. (Getty Images)

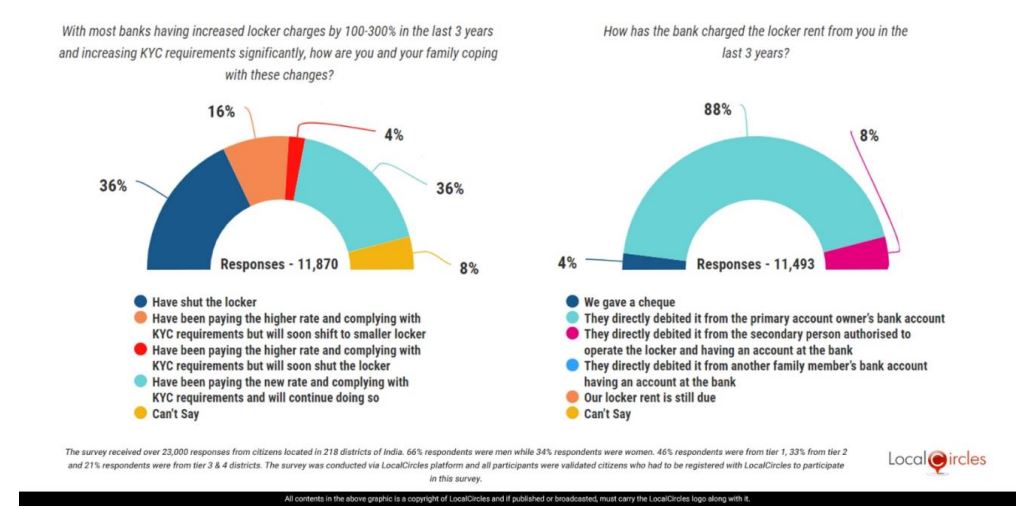

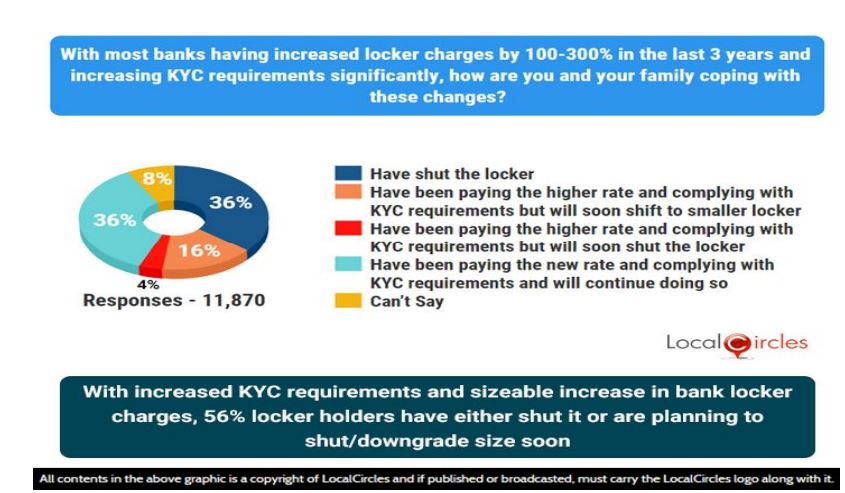

The survey said 36% of locker users have shut their bank lockers, 16% said they will shift to a lower-sized locker, while 4% were contemplating to shut down the locker due to the higher charges

Over half of bank locker customers have closed the facilities in the recent past or are mulling such a move due to cumbersome KYC requirements and increase in charges, according to a survey. Many such customers are also planning to reduce the size of the boxes because of these issues, the survey conducted by LocalCircles, which was released on Thursday, found.

The survey — conducted on 11,000 respondents — said 36% of locker users have shut their bank lockers, 16% said they will shift to a lower-sized locker, while 4% were contemplating to shut down the locker due to the higher charges.

The survey also found that 36% of the respondents are fine with the new charges, and will continue with the locker facilities.

In a statement, Localcircles said new rules for bank safe deposit lockers are coming into effect January 1 onwards, and ahead of the same, banks have been calling customers to visit the branch with necessary KYC documents for paperwork. Recent years have seen an increase in locker charges, it said.

Customers will have to sign a new legal lease contract with their bank for the safety lockers by December 31, LocalCircles said, adding that a steep hike in locker rental has seen 56% of locker holders surveyed either give it up in the last three years or are planning to shut/ shift to a smaller size soon.

Interestingly, as per a news report in January 2023 on a similar survey, only 14 per cent were mulling to give up their locker charges because the banks had hiked prices up to 300 per cent.