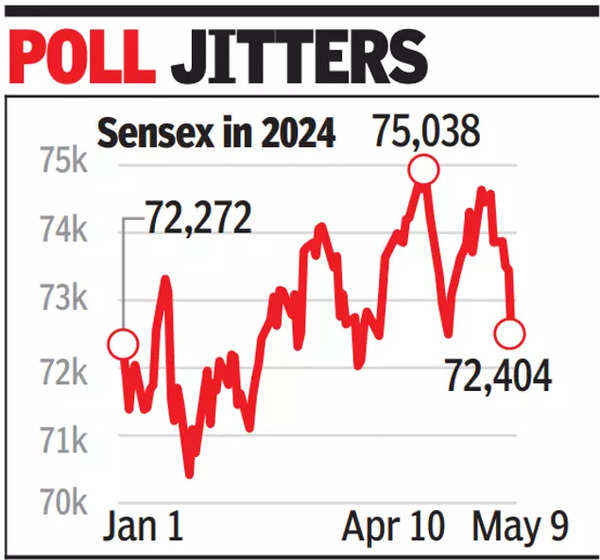

Sensex witnesses year’s 2nd biggest fall, back at January level

From an intra-day low at 72,334, sensex closed at 72,404, down 1,062 points. It was the second biggest fall this year.Nifty lost 345 points to close at 21,958 points. “Investors turned risk averse in the ongoing poll season and further lightened equity exposure to avoid being caught off guard,” said Prashanth Tapse, Senior VP (Research), Mehta Equities.

“Markets buckled under relentless selling pressure as investors turned risk averse in the ongoing poll season and further lightened their equity exposure to avoid being caught off guard,” said Prashanth Tapse, Senior VP (Research), Mehta Equities.

“As the election season is heating up, investors are trimming their equity exposure at a faster pace, which can be seen from the drubbing that mid and small-caps received,” he added.

Since Lok Sabha elections started on April 19, volatility in the market has increased substantially. Its measure, India VIX, on Thursday scaled a new multi-month high of 19.2 and closed at 18.20, up more than 40% since the polls started.

The sensex has also witnessed wild swings, although on a net basis it has barely moved. From around 72,300 a day before the first phase of the election, it scaled a peak at 75K on April 30 but has lost steam since then and is back at 72,400 level.

Despite wild swings, on a net basis investors’ wealth too have mostly remained almost unchanged – around Rs 400 lakh crore mark- since close of trading on April 18, the day before the Lok Sabha polls kicked off. On Thursday, however, investors were left poorer by about Rs 7 lakh crore. In the past few sessions, foreign funds have been aggressive sellers while domestic funds provided the cushion. So far this month, foreign portfolio investors have net sold stocks worth more than Rs 17,000 crore, data from CDSL and BSE showed. In comparison, domestic funds were net buyers at about Rs 16,700 crore.

The poll-related volatility in the market is expected to continue. According to Vinod Nair, Head of Research, Geojit Financial Services, Thursday’s fall in the leading indices were, among others, because of general election-related uncertainties and this is expected to continue in the short term. Technically too, the 22,000-point mark for nifty is a psychologically important level and the current close below this pivotal mark could weigh on investor sentiment, dealers and analysts said.

In Thursday’s market, among 30 sensex stocks, only five closed higher. In tbroader market, nearly 3,000 stocks on BSE closed lower compared to 843 that gained.