Government may allow stake dilution by Chinese companies

While the decision will still be on “case-by-case” basis, with security concerns being paramount, it could also lead to Xiaomi and some of the other well-known Chinese entities expanding their presence in India, sources indicated.

Since 2020, soon after the Covid-19 outbreak, govt has imposed checks on FDI from countries with land border with India — a move meant to check inflows from China — with tension at the Ladakh border resulting in even tighter scrutiny.

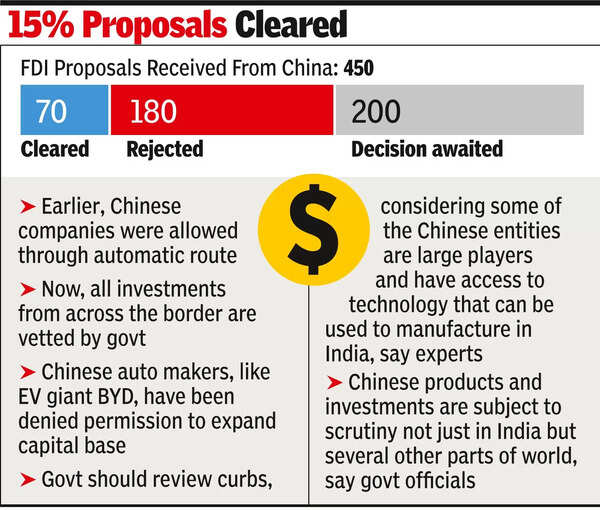

Unlike earlier, when Chinese companies could come through the automatic route, all investments from across the border are now vetted by govt. As a result, Chinese auto makers, like EV giant BYD, have been denied permission to expand their capital base. In fact, BYD had also proposed a joint venture with Megha Engineering, now of electoral bonds fame, but the plan was rejected by the home ministry.

In four years since the change in rules, govt has received around 450 applications from Chinese companies, of which 180 have been rejected. 70-odd got the nod, including some entities, which were seen to be crucial to ensure production of iPhones, for instance. Currently, around 200 proposals are pending with govt.

Some of the Chinese companies, which are headquartered in other countries have, however, managed to beat the checks.

Several experts have argued that govt needs to review the curbs, given that some of the Chinese entities are large players and have access to technology that can be used to manufacture in India. A dilution through the joint venture route, instead of earlier solo show by the Chinese companies may open the doors for expansion in several cases.

Govt officials have argued that Chinese products and investments are subject to scrutiny not just in India but several other parts of the world. Because of import restrictions, several companies are now locating plants in geographies close to the market.

As a result, during the Jan- March quarter, outbound FDI from China soared to an eight-year high of $33.5 billion, 13% higher than last year and the highest first quarter number since 2016, Bloomberg data showed.

We also published the following articles recently