At 18%, FPI stock holding drops to near 11-year low

“While actively managed funds held 7.1% in NSE listed companies, the balance 1.7% was held by passively managed funds.This has been led by strong net investments by mutual funds during this period, aided by ever-increasing fund mobilisation through the SIP route,” the report said.

Foreign investors, however, have raised stakes in companies outside of the blue-chip pack and cut their holdings in market heavyweights like Reliance Industries, Adani Enterprises and Kotak Mahindra Bank in the previous quarter.

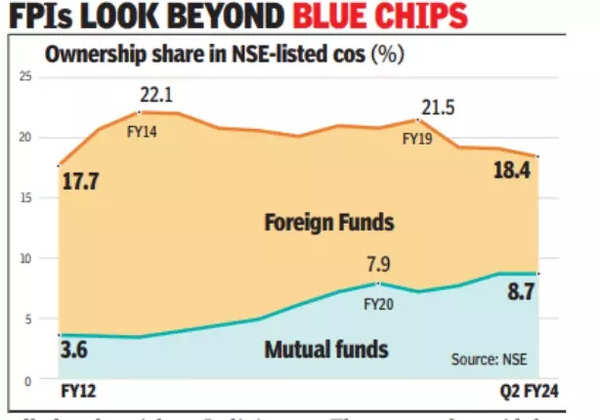

Foreign fund ownership in NSE-listed companies fell by 61 basis points (100bps = 1 percentage point) to 18.4% at September-end, the report said. For NSE’s top 500 companies, the corresponding number was 19.5% while for Nifty companies it stood at 25.2%.

Foreign portfolio investors (FPIs) maintained their outsized but sequentially tapered overweight bet on financials, turned incrementally less bearish on India’s consumption story with a sequentially higher exposure to consumer discretionary and consumer staples, the report said.

“(FPIs) retained a negative view on the investment theme with an underweight position on industrials, and maintained a neutral stance on other sectors (that include) IT, communication services, healthcare, utilities, energy and real estate.”

The report also noted that as of December 2022, foreign funds had holdings in about 1,770 companies, up from 1,450 companies as of December 2021 and 1,200 companies as of December 2020.

“FPIs meaningfully expanded their invested pool of companies between 2020 and 2022, but with an incrementally higher number of companies with a 5%-plus share,” it noted.

The report also said that MFs’ share in NSE-listed companies rose by 12bps to 8.8%, in Nifty 500 the corresponding numbers were a 21bps rise to 9.1% and for Nifty 50 a 35bps rise to 10.1% at the end of September.

The report also found that MFs had reduced their exposure in financial companies for the third quarter in a row, remaining overweight on the sector in Nifty 50 companies and neutral in Nifty 500 companies.

“MFs also turned neutral on industrials for the first time since 2005. Among other sectors, mutual funds retained their negative stance on consumer staples and energy, albeit incrementally less so, remained overweight on consumer discretionary and healthcare, and neutral on communication services, IT, materials, real estate and utilities.”