Dalal Street braces for volatility as Lok Sabha elections enter last leg

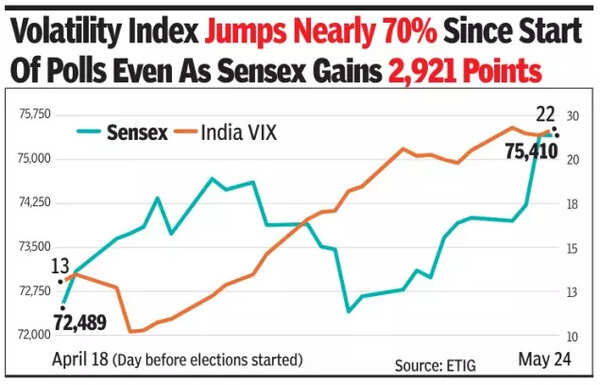

The sensex and Nifty scaled new life-time highs last week. Since April 18, on the eve of the first phase of Lok Sabha elections, the two indices have seen increased volatility. The volatility index has risen nearly 70% – a level not seen since Sept 2022, even as the sensex has gained 2,921 points (4%) while Nifty is up 961 points (4.4%) in the period. The sensex closed the week at 75,410 points while Nifty was at 22,957.

The recent rally in the stock market came despite substantial volatility, mainly on the back of strong selling by foreign funds, market players said. So far in May, foreign portfolio investors have net sold stocks worth a little over Rs 22,000 crore, CDSL data showed.

In contrast, domestic institutional investors have net pumped in nearly Rs 40,800 crore so far in the current month, BSE data showed. This is what has led to the up move in the leading indices, market players said.

According to V K Vijayakumar, chief investment strategist, Geojit Financial Services, the selling by FPIs – which began as a trickle in April and turned into a flood in May – was triggered by the massive outperformance of Chinese stocks in recent months, which in turn led to a ‘sell India, buy China trade’. “The (Lok Sabha) election-related jitters too might have influenced FPI selling,” he said.

Vijayakumar, however, feels that the situation is once again slowly changing and market players feel that the ruling BJP-led govt will come back to power on June 4. “Also, the massive selling (by FPIs) has eased and they have even turned buyers in recent days. Going forward, as clarity emerges on the election front, FPIs are likely to buy in India since they cannot afford to miss the post-election results rally. Actually, the rally may begin even before the election results,” he said in a note.

Among the stocks, Adani Ports & SEZ and Wipro would be among the large caps to watch out for in the next week. This is after the BSE, after markets closed on Friday, announced the inclusion of the Adani group firm into sensex while excluding Wipro from it, effective June 24. Usually, after such rejigs, investors tend to buy the stock that’s being included into the index while they sell the one being excluded.

In addition to poll results, global cues and the final phase of the earnings season would decide the market’s trend in the coming few days, said Ajit Mishra of Religare Broking.