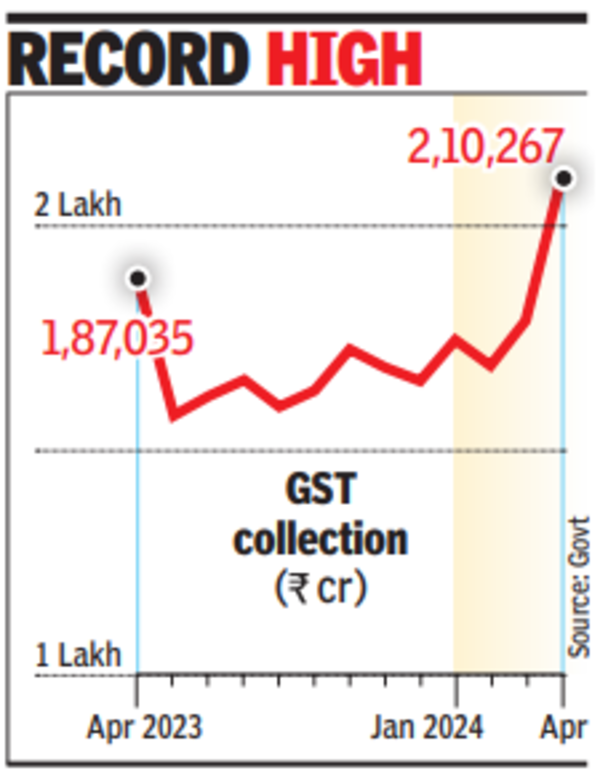

GST April mopup soars 12.4%, crosses Rs 2 lakh crore for 1st time

The mop-up from domestic transactions was seen to have risen 13.4%, while the figure from imports was up 8.3%. After accounting for refunds, the net GST revenue went up 15.5% to Rs 1,92,000 crore. The numbers buoyed the mood in govt. Post-Covid there has been a consistent rise in collections.

‘GST mop-up reflection of better biz compliance’

Finance minister Nirmala Sitharaman tweeted, “GST collection crosses Rs 2 lakh crore benchmark, thanks to the strong momentum in the economy and efficient tax collections. Congratulations to the Central Board of Indirect Taxes & Customs, dept of revenue, all officers at the state and central levels. Their sincere and collaborative efforts have achieved this landmark”.

It started with the crackdown on bogus registration and fake invoices along with tightening of norms, with data analytics playing a key role.

“These collections could be the tipping point in the GST collection trajectory. While some part of the increased collections are attributable to the financial yearend upswing, it is also reflective of significant improvements in compliance by businesses. The relentless focus on audits by central and state GST authorities together with periodic drives to stamp out evasion has led to this,” said M S Mani, partner at Deloitte India.

Among states, Mizoram led the growth charts with a 52% jump in April, while Sikkim (down 5%), Nagaland (3% lower), and Meghalaya and J&K (2% fall) lagged. Among the bigger states, UP recorded a 19% increase, followed by Maharashtra and Gujarat (13% each), Karnataka (9%) and Tamil Nadu (6%).

“With the next wave of GST reforms expected after the formation of a new govt, growth may be further accelerated. It may also enable the govt to take bolder decisions, such as rate rationalisation or bringing products such as ATF and natural gas under GST ambit,” said Partik Jain, partner at PwC India.