SME IPO frenzy! Manic interest from retail investors, but here’s why you need to exercise caution

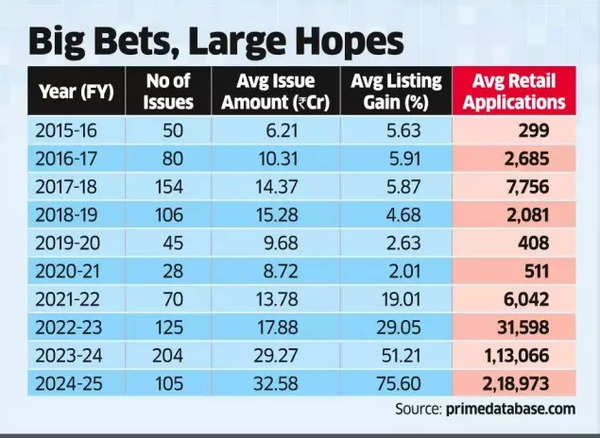

According to an ET report, the number of applicants for these high-risk share sales has skyrocketed in recent years.In FY20, an average of just 408 individuals applied for each SME IPO, rising slightly to 511 in FY21. However, in the current fiscal year, FY25, the average number of applicants has soared to an astonishing 219,000 per offering.

Despite the inherent risks and the requirement to invest a minimum of Rs 1 lakh, retail investors have not been deterred.

Big Bets, Large Hopes

The average gain on listing price in FY25 stands at an impressive 76%, with some IPOs, such as Hoac Foods India, Medicamen Organics, Koura Fine Diamond Jewelry, and Maxposure, seeing the retail portion oversubscribed by more than a thousand times.

The surge in retail interest began in earnest in FY23, fueled by significant rallies and substantial listing gains in certain issuances. In FY22, the average number of applications was 6,042, with average listing gains of 19%. This momentum continued in FY23, with the average number of applications rising to 31,500 and listing gains increasing to 29%. FY24 saw even more impressive figures, with average listing gains exceeding 50% and the number of applications reaching 113,000 per IPO.

Pranav Haldea, managing director of PRIME Database Group, attributes this enthusiasm to the allure of potential gains in a bullish market.

Also Read | These mutual funds have returned 100% more than Nifty! Where should investors put their SIP money?

He was quoted as saying, “In a bullish market, investors tend to invest in all IPOs, hoping for allotments in some, due to the high likelihood of listing gains.” He also notes that the simplicity of investing through trading apps has made the process more accessible, requiring just a few clicks and allowing funds to remain in the investor’s bank account until allotment.

SME IPOs: Note of caution

The Securities and Exchange Board of India (Sebi) has issued a cautionary advisory regarding investments in securities of companies listed in the SME segment. This comes in response to the frenzy surrounding SME IPOs. Sebi stated that certain SME companies and their promoters have been employing tactics to present a misleadingly positive picture of their operations, and then capitalizing on this momentum to offload their own holdings at a profit.

Also Read | Who are India’s richest investors? These top individual investors made more money in June quarter

In an effort to bring more stability to the opening price discovery process for SME stocks, the National Stock Exchange implemented a cap of 90% over the offer price for SME IPOs during a special pre-open session on listing day in early July. It is noteworthy that approximately 60 IPOs this year listed between 90% and 400% above the issue price.

Several market experts have also advised retail investors to exercise caution in this regard.

Haldea, highlights a pressing concern. “What is even more troubling is that many retail investors today are relatively new entrants, having opened their demat accounts only in the last 3-4 years. Consequently, they have not experienced significant market corrections or major frauds, which make them more susceptible to risks,” he said.