Net FY23 household savings hit 5-year low

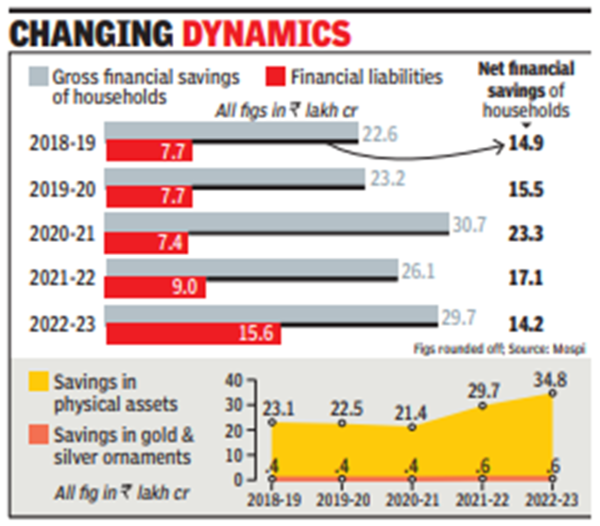

Net financial savings of households were down to five-year low of Rs 14.2 lakh crore in 2022-23 from Rs 17.1 lakh crore in 2021-22.These had reached a high of Rs 23.3 lakh crore in 2020-21 but since then have been displaying a falling trend. The previous low was at Rs 13.1 lakh crore in 2017-18.

The gross financial savings of households were at Rs 29.7 lakh crore, while financial liabilities were estimated at Rs 15.6 lakh crore in 2022-23, according to the latest data. Financial liabilities were at their highest level in 2022-23 since 2011-12 when these were at Rs 2.9 lakh crore.

Household savings, which account for over 60% of total savings, are split between financial and physical savings and net financial savings are estimated as the difference between gross savings and household borrowings/liabilities.

Savings in physical assets were at Rs 34.8 lakh crore in 2022-23, while in gold and silver ornaments these were at Rs 63,397 crore – highest since 2011-12 when these were at Rs 33,635 crore. Bank advances to households nearly doubled to Rs 11.9 lakh crore in 2022-23 from Rs 6.1 lakh crore in 2020-21, the data showed. These were at Rs 7.7 lakh crore in 2021-22. The investment in mutual funds by households grew 20.6 times to Rs 1.8 lakh crore in 2022-23 from Rs 8,694 crore in 2011-12.

Experts said the data shows that access to credit due to various initiatives by govt has risen in recent years, prompting households to borrow and invest in housing and other physical assets.

“The NSO data also shows that while net financial savings fell, physical savings rose. Households have clearly used borrowings to acquire physical assets such as homes, which pushed up physical savings. This was also reflected in strong housing demand,” said D K Joshi, chief economist at ratings agency Crisil.

He said that over the years, savings in physical assets have always been higher than in financial assets. But with financial inclusion gathering pace in the past decade or so, financial savings accelerated and the gap with physical savings narrowed. During the Covid-19 pandemic, there was a sharp jump in the financial savings rate, while the physical savings rate fell.

“In fiscal 2021, net financial savings rose temporarily above physical savings. Some of this was corrected after the strong rebound from the pandemic began. Not surprisingly, household savings in physical assets have exceeded their net financial savings,” said Joshi.