Playing it again: What Sam Pitroda said & status of inheritance tax in India, abroad

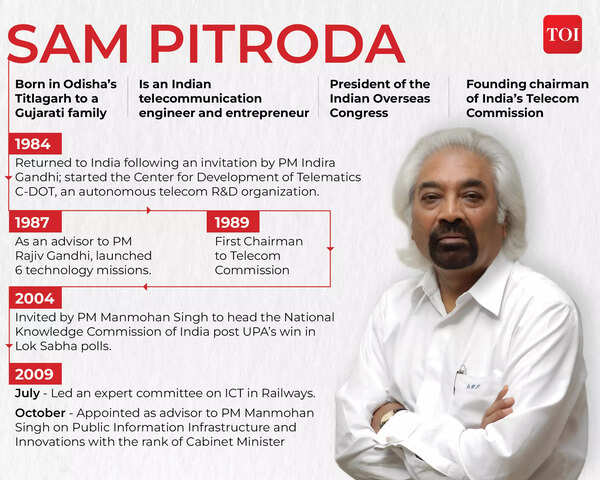

Indian Overseas Congress chairman Sam Pitroda’s comments on inheritance tax triggered a political slugfest on Wednesday with PM Modi attacking Congress for planning to impose higher taxes and not wanting people to pass on their hard-earned income to their heirs. Congress distanced itself from Pitroda’s remarks, and party spokesman Jairam Ramesh said former PM Rajiv Gandhi had, in fact, abolished estate duty in 1985.Here’s what the hullabaloo’s all about:

What did Pitroda say?

He backed the idea of an inheritance tax and cited the example of the US. “Nothing wrong in accumulating wealth but to what point? Let me tell you, in America there’s an inheritance tax. So, if let’s say one has $100 million worth of wealth, and when he dies he can transfer probably 45% to his children, 55% is grabbed by govt. Now that’s an interesting law. It says you, in your generation made wealth, and you are leaving now, you must leave your wealth for the public – not all of it, half of it, which to me sounds fair. In India you don’t have that. If somebody is worth $10 billion and dies his children get $10 billion. The public gets nothing. So these are the kinds of issues that people will have to debate and discuss.”

Why the controversy?

Pitroda’s comments on inheritance tax come against the backdrop of the Congress manifesto talking about addressing “growing inequality of wealth and income through suitable changes in policies” and Rahul Gandhi’s speeches pushing for economic and institutional surveys, along with caste census. BJP has cited Rahul’s speeches to claim that the surveys would be a prelude to “redistribution” of wealth.

What is inheritance tax?

This is a tax which is levied on property inherited when a person dies. According to Tax Foundation, a think tank on taxation, estate and inheritance taxes are broadly similar because both are generally triggered by death. Estate taxes are levied on the net value of property owned by a deceased person on the date of death. In contrast, inheritance taxes are levied on the recipients of the property, according to the foundation’s definition.

Tackling inequality…

Inheritance tax has in some cases been justified to ensure “equality of opportunity”. An OECD paper says that by breaking down the concentration of wealth and correcting for factors that are beyond the recipients’ control, inheritance and gift taxation can contribute to levelling the playing field across individuals, and thereby increase equality of opportunity and improve social mobility. It cites Thomas Piketty, Saez and Zucman, who have argued that from a meritocratic perspective, inherited wealth should be taxed at higher rates than earned income and self-made wealth. There is an argument against the tax and critics in the US say scrapping it would help raise investments, create jobs and help in expansion of the economy.

What is the global scene?

Several advanced countries, including the US, UK, Japan, France, and Finland, have inheritance tax ranging from 7% to 55%. Since 2000, 11 countries and two tax jurisdictions have scrapped estate or inheritance tax, according to Tax Foundation data. US prez Joe Biden has backed increasing the inheritance tax rate to 61%.

Did India have inheritance tax?

India did have an inheritance tax, and levied a peak rate of 85% estate duty, which was abolished in 1985. Death of a property owner triggered the liability on estate duty. According to tax consulting firm Taxmann, ‘property’ was defined in the broadest possible terms and included all movable and immovable assets, interest in expectancy, interest in co-parcenary property (joint heirship), debt or enforceable right, etc. “The liability on estate duty was cast on the recipient of the estate who was to file a return of estate received based on which the competent authority would complete an assessment. In case an asset was inherited jointly, a joint return was required to be filed,” according to Taxmann.

Several measures to bring social equity have been imposed in the country, including gift tax, wealth tax and estate duty. Wealth tax was scrapped in 2015, while gift tax was withdrawn in 1998 but reintroduced in 2004, levying income tax on gifts to relatives. There was speculation in 2020 that the Union Budget may bring back estate duty. In 2014, the then junior finance minister Jayant Sinha had backed the idea of bringing inheritance tax but it did not move beyond the idea stage.